Should I Take On a Rehab Before Selling My House?

Should I Take On a Rehab Before Selling My House?

When considering selling your home, the idea of rehabbing or renovating it to increase its value can be tempting. However, not all rehab projects are created equal, and many homeowners may not see the return on investment (ROI) they expect. This article explores whether taking on a rehab before selling your house is a wise decision, using facts and figures to highlight the potential pitfalls and considerations.

Understanding Return on Investment

Data from the Cost vs. Value Report at

(learn more by clicking here) shows that while some home improvement projects can increase your home’s value, they often do not recoup their full cost. For example, a mid-range kitchen remodel might recoup about 77.6% of its cost, while a bathroom remodel might only recoup 64.0%. Here are some key points to consider:

-

Minor Kitchen Remodel: Average cost $26,214; resale value $18,927; cost recouped 72.2%.

- Bathroom Remodel: Average cost $24,424; resale value $15,388; cost recouped 63.8%.

- Roofing Replacement: Average cost $24,700; resale value $16,287; cost recouped 65.9%.

These figures indicate that while these improvements can make your home more attractive to buyers, they typically don’t pay for themselves in full.

The Hidden Costs of Rehabbing

When planning a rehab, it’s crucial to consider not just the renovation costs but also the hidden expenses that come with it:

-

Carrying Costs: While rehabbing, you’ll continue to pay mortgage, insurance, property taxes, and utilities. These costs can add up significantly over time.

- Borrowing Costs: If you need to borrow money to finance the rehab, interest payments can further reduce your net gain.

- Project Delays: Home renovation projects are notorious for running over time and budget, causing additional stress and costs.

- Real Estate Agent Commissions: Using a traditional real estate agent typically involves paying a commission of around 6% of the sale price, along with other closing costs. This further reduces the amount you net after the sale.

Is It Worth the Effort?

Given these considerations, the ROI on rehabbing your home might not be as high as expected.

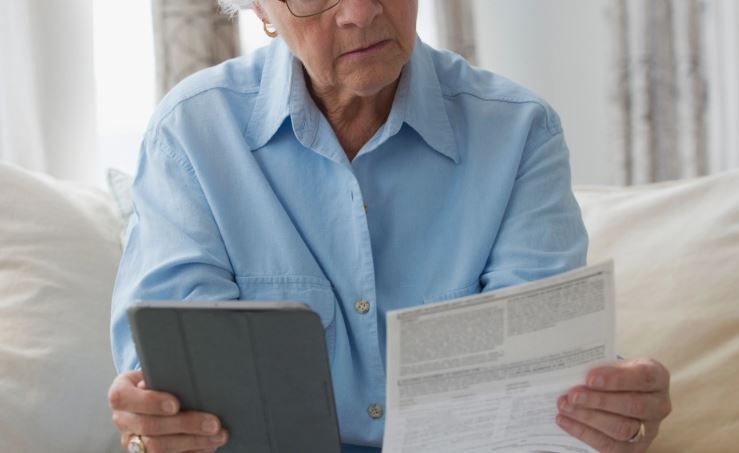

See our article on rehabbing and returns. For many homeowners, especially those selling a property belonging to a parent or senior transitioning to higher-level care, a rehab project's financial and emotional investment may not be worthwhile. Here’s why:

-

Uncertain Market Conditions: The real estate market can be unpredictable. Spending significant money on a rehab doesn’t guarantee a proportionate increase in your home’s sale price.

- Emotional and Physical Strain: Rehabbing a home is not only costly but also time-consuming and stressful. This can be particularly burdensome for seniors or those handling an estate.

- Opportunity Cost: The time and money spent on rehabbing could be used for other investments or expenses, which might offer better returns or be more pressing.

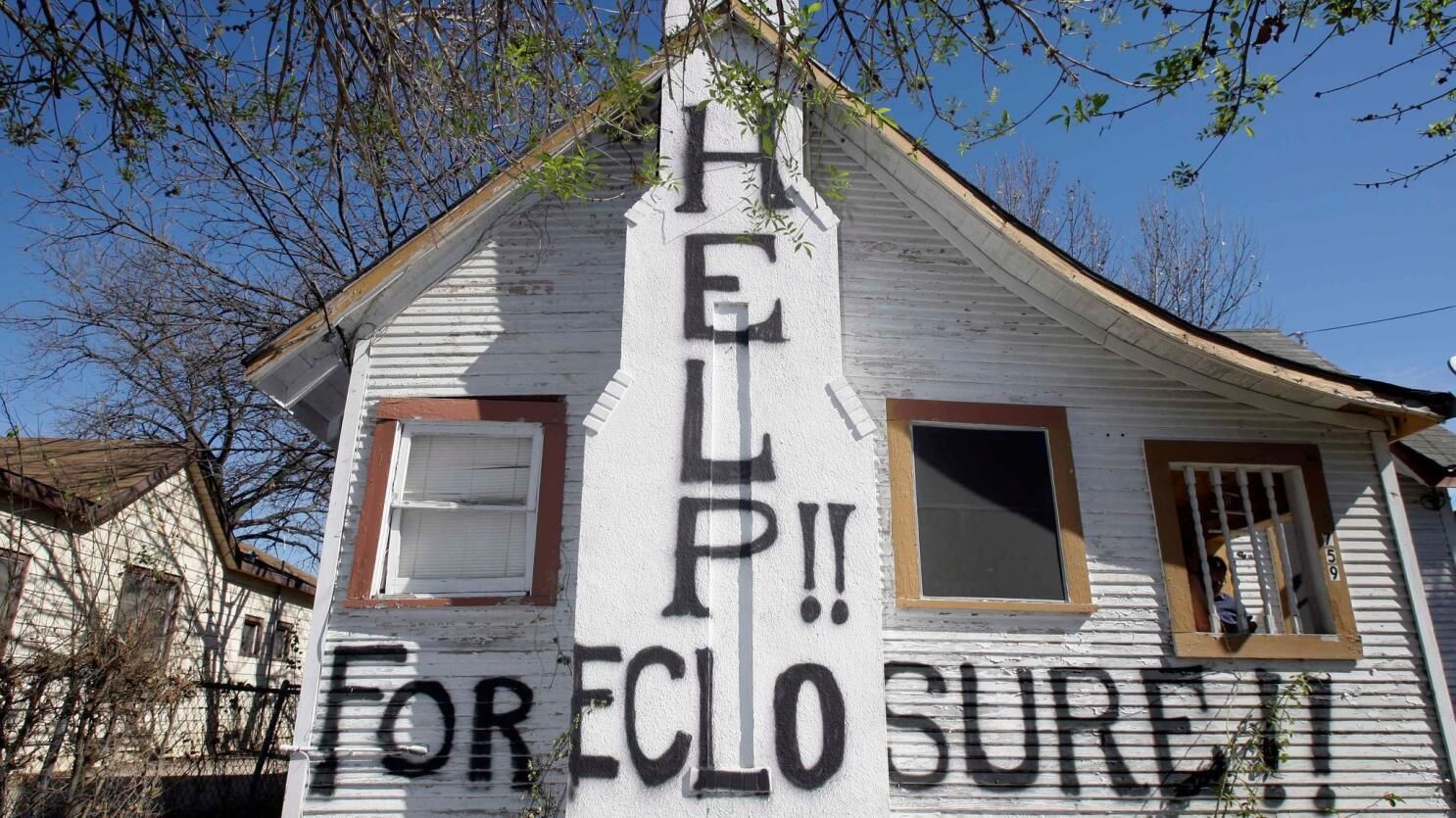

Selling As-Is: A Viable Alternative

Selling your home as-is can be a more practical and financially sound option. Here are some advantages:

-

Faster Sale: Homes sold as-is typically sell faster, reducing the time you spend on the market and carrying the costs associated with that. This can represent a significant savings if you sell your house as-is.

- Lower Stress: Avoid the hassle and stress of managing a rehab project, dealing with contractors, and overseeing renovations. You do not have to clean up, clean out, or make the house ready for tours.

- Financial Certainty: Selling as-is provides immediate financial clarity without the uncertainties of a renovation’s final cost and outcome.

The bottom line? While rehabbing your home can potentially increase its value, the costs and risks involved often outweigh the benefits. The data from the Cost vs. Value Report shows that most renovation projects do not recoup their full cost. In addition to losing money that you would recoup on making improvements, the additional carrying costs, borrowing costs, and real estate commissions can further erode your net gain, leaving you less profit overall.

For many homeowners, especially those managing the sale of a parent’s or senior’s home, selling as-is may be the more prudent and less stressful option. To make an informed decision, see our articles on cost versus value and considerations for borrowing money for renovations. Ultimately, carefully weighing the potential benefits against the financial and emotional costs before embarking on a rehab project will help you determine the right course of action for your specific circumstances.

If you're considering selling your house and it's retail-ready, we have several real estate agents that we know, like, and trust that we can refer you to. However, if you would like more information so that you can make the best decision for your situation, if you have some questions, or if you would like to get a no-obligation offer for your house as it is today,

just click here and we will get you a no-obligation offer the same or next day.