The Fed Lowers Interest Rates: How It Affects Your Mortgage and Buying Power

The reduction in overall interest rates and the potential decrease in inflation can offer a boost to homebuyers, especially those looking for homes in Kansas City and other regions.

On September 18th, 2024 the Federal Reserve took a long-awaited and significant step by lowering interest rates a half of a percentage point. This decision reverberates across many aspects of the economy, including mortgage rates and consumer buying power. While mortgage rates are more closely tied to the bond market than directly to the Fed’s actions, the reduction in overall interest rates and the potential decrease in inflation can offer a boost to homebuyers, especially those looking for homes in Kansas City and other regions.

How Does the Lower Interest Rate Affect Mortgage Rates?

Mortgage rates are generally influenced by long-term Treasury bonds. While the Fed's decisions impact short-term rates, the bond market tends to move in response to economic conditions, inflation expectations, and investor confidence. However, when the Fed lowers rates, it often signals a softer stance toward inflation and economic growth. As inflation declines, bond yields may decrease, which can ultimately lead to lower mortgage rates.

For homebuyers, this could translate to a drop in monthly mortgage payments, giving them the ability to afford a more expensive home or reduce their overall debt burden. Even a small decrease in mortgage rates can significantly impact purchasing power, allowing buyers to stretch their budgets further.

Increased Consumer Confidence and Buying Power

The impact of lower interest rates extends beyond mortgage payments. With the Federal Reserve aiming to ease inflation and stimulate the economy, consumers are likely to see lower costs on everyday purchases such as gas, groceries, and other household items. This creates a ripple effect: as people save more on daily expenses, their disposable income increases, leading to a higher sense of financial security.

This heightened confidence can play a crucial role for potential homebuyers. In Kansas City and other markets, families might feel more empowered to make long-term investments like purchasing a home. When consumers have more disposable income, they tend to feel more secure in making significant financial decisions, like buying a house, which often feels less risky during times of economic stability.

The Importance of Affordable Home Programs

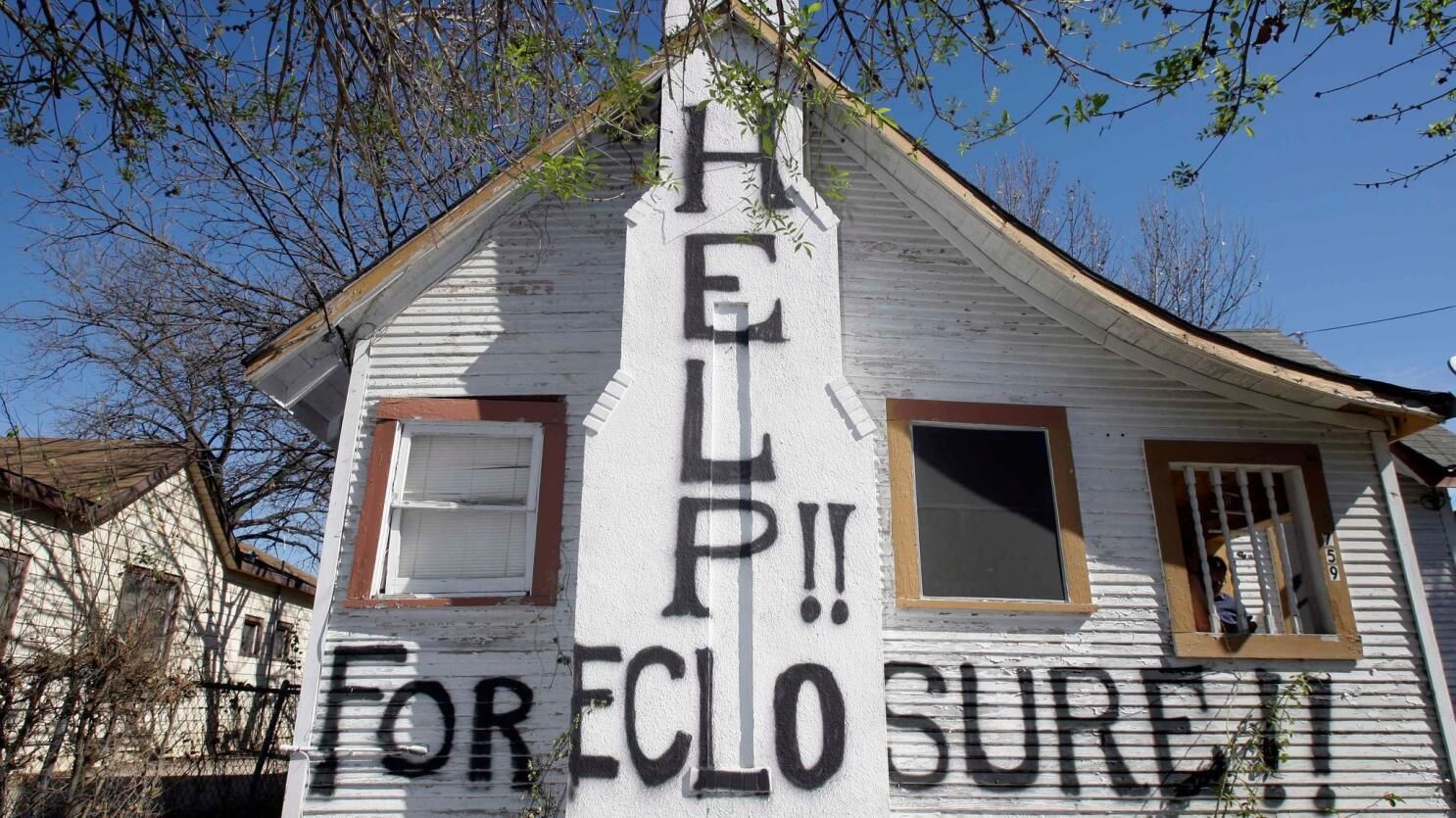

The Fed's rate cuts come at a time when many families are not just selling their homes but also looking to buy their first home. For families with less-than-perfect credit, these economic shifts offer both opportunities and challenges. That's where affordable home programs come into play.

At Family Shepherd, we understand the hurdles that many first-time buyers face, especially those who may not have a high credit score. Our affordable home program is designed to help families get into a home without the traditional barriers. We offer solutions that provide flexible down payments and manageable monthly rates, making homeownership a reality for those who might otherwise be locked out of the market.

Should You Sell Your Home for Cash?

Even though the housing market might see a temporary uptick with lower interest rates and increased buyer confidence, selling your house for cash could still be your best option, especially if you need a quick and easy sale.

If your home requires significant repairs or you're in a situation where selling quickly is crucial—perhaps you're helping a loved one transition into senior living—selling your house as-is for cash can eliminate many of the traditional hassles associated with home sales. Cash buyers often make offers that allow you to skip the staging, repairs, and lengthy listing processes.

For many homeowners, especially those in Kansas City, selling for cash provides a flexible solution that can ease financial stress and reduce the complexities of the sales process. Be sure to read our article on selling your home for cash to explore the benefits and whether it might be the right choice for your situation.

Conclusion: Why This Matters for Kansas City Homebuyers

The combination of lower interest rates and reduced inflation means that buyers in Kansas City and elsewhere have more financial flexibility. With more disposable income and potentially lower mortgage rates, consumers are better positioned to purchase homes. Programs like our affordable homeownership initiative ensure that families, regardless of credit status, can take advantage of these favorable economic conditions and secure a place to call their own.

If you're thinking about buying or selling a home in Kansas City, now might be the perfect time to explore your options. Whether you decide to list traditionally or sell as-is for cash, this shift could help you make a move towards homeownership or a simplified sale today. If you would like more information about how to sell your home, click

here.