Post-Pandemic Gains in Homeownership for Black and Latino Families at Risk Due to Rising Mortgage Rates

During the pandemic, Black and Hispanic homeownership rates in Kansas City and nationwide saw significant increases. Black homeownership rose by 2 percentage points, while Hispanic homeownership grew by 2.5 points, compared to a more modest 1-point increase for white homeowners. Historically, low mortgage rates played a crucial role, particularly for high-earning, educated buyers in Black and Latino communities, helping many enter the housing market for the first time, despite facing disproportionate challenges during the pandemic.

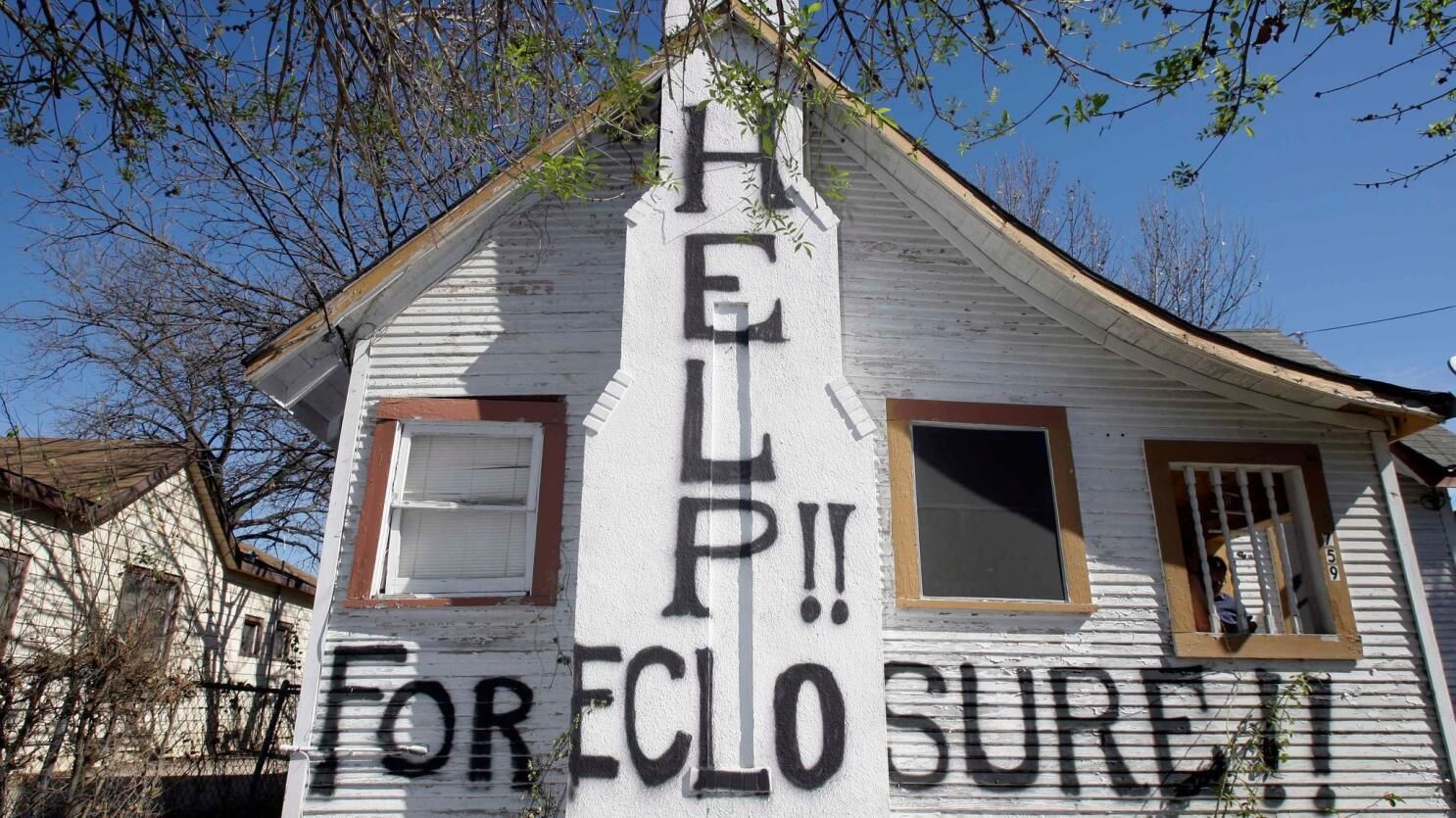

From 2019 to 2021, Black homeownership increased from 42% to 44%, while Hispanic homeownership climbed from 48.1% to 50.6%. This trend marked a significant recovery for Black households, who had seen steady declines in homeownership since the Great Recession. However, the rising mortgage rates and inflation following the pandemic now threaten to reverse these gains.

Young, High-Earning Buyers Lead the Way

The most significant increase in homeownership was seen among younger buyers, particularly those under 45. Across all racial groups, homebuyers in this age group increased from 51% to 55% between 2019 and 2021. For Black homebuyers, the share of those under 45 grew by 5.3 percentage points, while Latino homebuyers saw a 4-point increase. This demographic shift played a critical role in homeownership growth, especially among high-earning households. Incomes for Black and Latino buyers increased by 9% and 7%, respectively, helping them secure loans in a competitive market.

However, the rise in Kansas City homeownership came with challenges, particularly for buyers relying on government-backed loans like FHA or VA loans. In a ‘sellers market’, where houses often sell quickly, and for above asking price, often with more than one buyer competing to ‘win’ the house, FHA and VA loans were less attractive to sellers due to having longer closing times and stricter conditions to approve a home for the loan in comparison to conventional loans.

Racial Disparities and Income Gaps Persist

Despite the gains, racial disparities in homeownership persist. For households earning between $100,000 and $149,999, Black homeownership rates remained at 68%, while Hispanic households reached 67%. In contrast, white households in the same income bracket enjoyed an 83% homeownership rate. Much of this disparity is due to generational wealth, where white families have often been more financially able to provide down payment assistance to younger buyers.

Policy Recommendations to Close the Gap

To continue the momentum of increasing homeownership rates for Black and Latino households, policymakers and organizations like the

Urban Institute have suggested several targeted interventions. These include down payment assistance for first-generation homebuyers, special credit programs for borrowers of color, and incorporating rental payment history into mortgage underwriting to benefit renters who may have low or no credit scores.

Family Shepherd: Supporting Families in Transition and Homeownership

At

Family Shepherd, we understand the complexities involved in buying and selling homes, especially for families transitioning into senior living or moving in with loved ones. While our marketing often emphasizes buying homes "as is," we also focus on rehabbing and reselling many of these properties, oftentimes as entry-level homes for families.

We take pride in offering creative solutions, including owner financing, to help families who may not qualify for traditional mortgages. If you or someone you know is searching for a home, whether this is their forever home or their starter home, fill out the form on our website to join our Home Buyers List. We offer new opportunities each month for families to find a home with our assistance.

Additionally, if you're seeking a reliable mortgage professional, we have excellent resources to help guide you through the process. At Family Shepherd, we are committed to helping families navigate every aspect of their home-buying journey.

Reach out today to see how we can assist you!