Bridge Loans for Seniors Transitioning to Senior Living: A Cautionary Overview

As seniors consider transitioning from their single family home into senior living communities, financing the move can be a significant concern. Bridge loans are often touted as a convenient solution, providing temporary funds to cover the immediate costs of moving into senior living communities. However, it's essential to understand why bridge loans might not always be the best option for seniors.

Understanding Bridge Loans:

Bridge loans are short term loans designed to "bridge" the gap between immediate funding requirements and the availability of longer term financing or resources. In the context of senior living, these loans help cover entry fees or deposits for a senior living community while the Senior's current home is on the market for sale.

Risks and Concerns:

1.

High Interest Rates and Fees:

Bridge loans typically come with higher interest rates compared to traditional loans. Additional fees, such as origination fees or administrative costs, can add to the financial burden.

2.

Short Repayment Terms:

These loans usually require repayment within a short timeframe, often within a year. The pressure to sell the current property quickly might lead to accepting a lower sale price, adversely impacting the senior’s financial situation.

3.

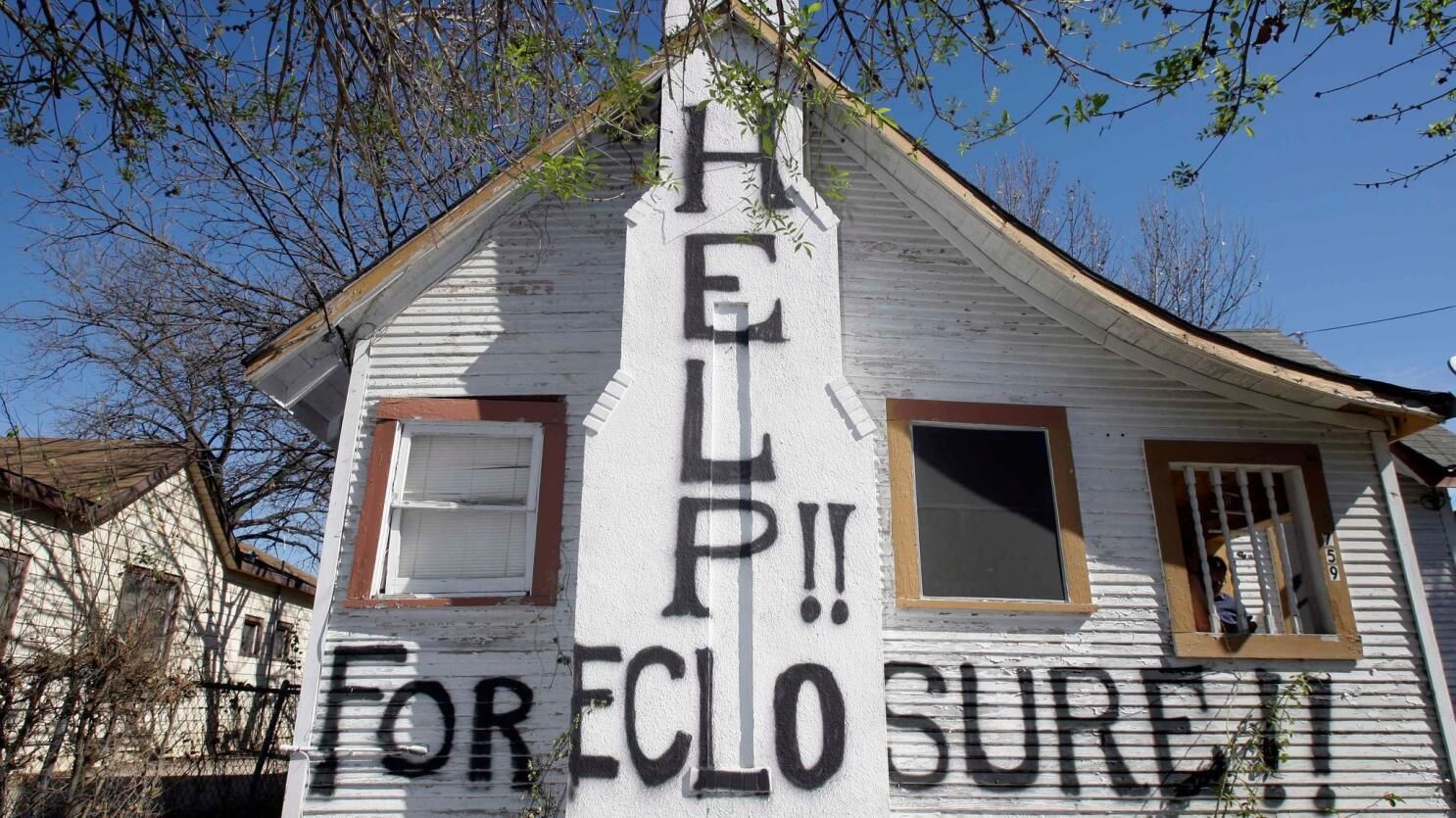

Debt Accumulation:

If the senior’s home does not sell as quickly as anticipated, the interest on the bridge loan continues to accrue, leading to increased debt. In a declining housing market, this could mean the loan amount exceeds the home's sale proceeds.

4.

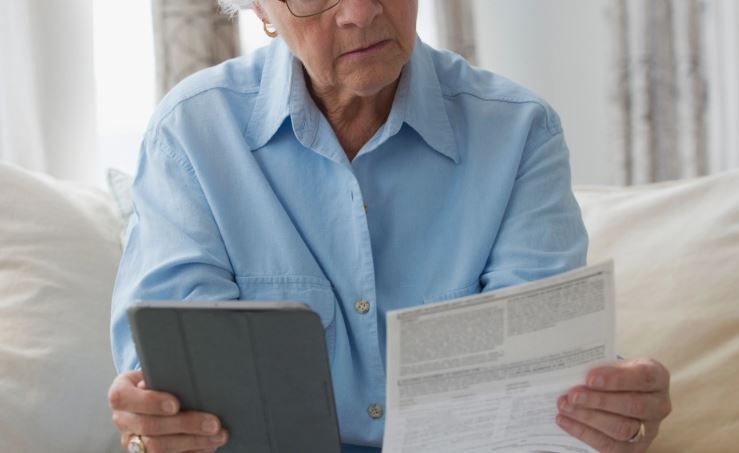

Complexity and Stress:

Managing a bridge loan requires understanding complex financial terms and conditions.

This can be stressful and overwhelming, especially for seniors already dealing with the emotional aspects of transitioning to a new living environment.

5.

Impact on Future Financial Planning:

Bridge loans can affect a senior's overall financial health, especially if they are on a fixed income. The financial strain may impact the ability to afford ongoing expenses in the senior living community.

Alternatives to Consider:

1.

Home Equity Line of Credit

(HELOC):

A potentially lower interest option that allows seniors to borrow against their home equity.

2. Personal Savings or Investments:

Using personal funds, if available, to cover initial costs without incurring debt.

3.

Downsizing First:

Selling the current home and moving to a more affordable interim option before transitioning to senior living.

4.

Renting Out the Home:

Generating rental income from the current home to fund senior living expenses.

5.

Seeking Financial Advice: Consulting with financial advisors to explore other funding options tailored to the senior's specific financial situation.

While bridge loans offer an immediate solution for funding senior living transition costs, their potential risks and financial implications often make them a less favorable option for many seniors. It's crucial for seniors and their families to thoroughly evaluate their financial situation and explore all available options before making a decision. Seeking professional financial advice can also provide valuable guidance in this important life transition. If you would like us to connect you with a trusted financial advisor to help you with these decisions,

fill out the form here and we will make that introduction.

Supporting the Senior Living Industry

Recent Helpful Articles

Quick Links

Our Location

ALL RIGHTS RESERVED | FAMILY SHEPHERD | PRIVACY POLICY