Paying for Independent Living: What You Need to Know

If you or your loved one is an active, healthy senior looking for more socialization and a maintenance-free lifestyle, considering Independent Living is a great choice. Independent Living communities offer benefits like activities, dining, and regular housekeeping. However, they don't include personal care or medical services. Independent Living may be a good option, as many people are selling their homes and moving to Independent Living for a change in lifestyle. Consequently, paying for Independent Living is more similar to paying for an apartment or condo. We often hear people say that they wish there was a guide to help people understand the costs and explore the different ways to fund this lifestyle.

Can You Afford Independent Living?

Let our free assessment guide you to the best senior living options tailored to your budget. The financial component is one of the most important factors for most people. We can help with:

1.

Understanding Costs: The first step is to anticipate the costs of Independent Living. Factors such as location, amenities, and community size affect pricing.

2. Private Pay Options: Personal funds, insurance, and assets are typically used to cover these costs.

3. Veterans’ Benefits: Eligible veterans may use military and veteran-related programs to pay for Independent Living.

4. Public Benefits: Specific public benefits might assist in paying for Independent Living under certain circumstances.

Knowing What Costs to Expect

The median cost of Independent Living in the United States is $3,100 per month, according to a recent study on the cost of long-term care in 2024. However, this can vary widely based on the community’s location, size, and amenities. Independent Living costs tend to peak in major metropolitan areas.

Questions to Consider:

- Are the community’s rent costs all-inclusive? Do residents have to pay extra for meals, activities, and amenities like fitness classes or salon services?

- Does the community offer move-in specials or discounts based on the length of the lease?

- Are there different floor plans available at varying prices?

- Can rent costs be reduced by having a roommate?

- Are there any one-time costs such as a move-in fee? If so, are these refundable if the resident leaves?

Independent Living might reduce or eliminate expenses like food, transportation, and housekeeping, potentially offsetting higher rent costs.

Paying for Independent Living Using Personal Funds

Most seniors use personal savings to pay for Independent Living. This includes pensions, retirement accounts, proceeds from selling a home, and investments. Income from Social Security or part-time jobs can also contribute to these costs. Additionally, if medical care services are needed within an Independent Living facility, seniors might qualify for tax cuts related to medical expenses.

Paying for Independent Living Using Insurance

Long-Term Care Insurance: Long-term care insurance typically covers health and personal care costs, making it more applicable to assisted living, memory care, and skilled nursing facilities than Independent Living. These benefits usually apply when seniors need help with ADLs or have cognitive impairments. Therefore, long-term care insurance generally doesn’t cover Independent Living costs.

Life insurance policies can be a substantial financial resource. Options include:

-

Selling the Policy: Cashing out the policy.

- Surrendering the Policy: Exchanging the policy for its cash value.

- Policy Loans: Borrowing against the policy and repaying it to maintain benefits.

- Living Benefits: Using part of the policy's funds while preserving the remainder for family members.

Consult with your insurance company to understand the specifics and regulations of your policy.

Paying for Independent Living Using Assets

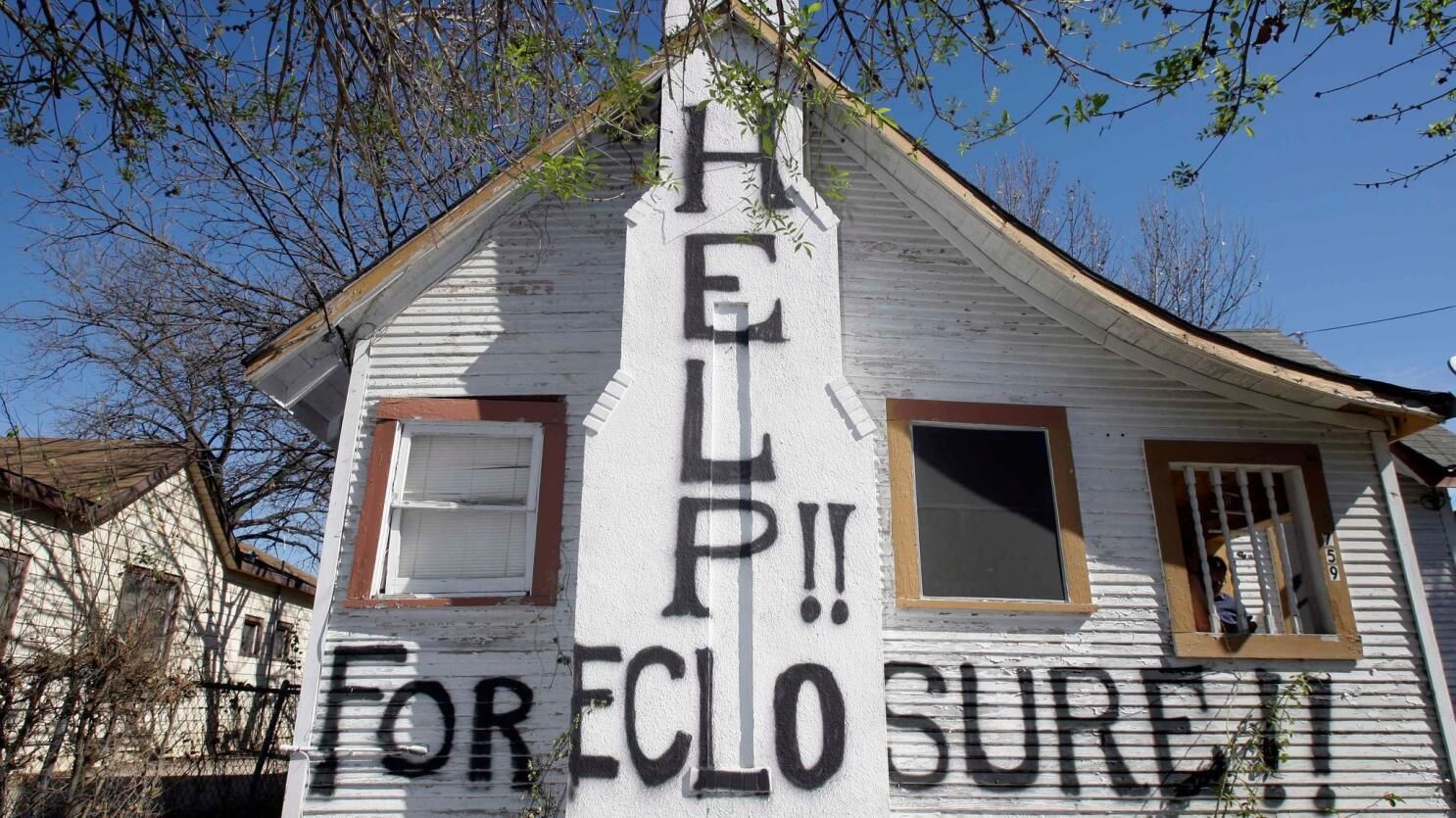

Selling the Home is one of the most common ways that people fund Independent Living. See our article on selling your home and the things you should consider.

Many seniors sell their homes to fund their transition to Independent Living. Working with a real estate agent or a real estate investment company that has experience with older adults, can simplify this process. Many times companies will buy the house as-is, so there's no need to do any fix-up or invest money in your home.

Family Shepherd

will purchase the home as-is, with no contingencies, no clean up, repairs, or updates needed. To understand more about this process click

here.

Renting Out the Home

Renting out the home can provide a steady income stream and may be more lucrative long-term. Property management companies can handle tasks like finding tenants, setting rent prices, and managing the property.

Selling Other Assets

Selling additional assets, such as a second vehicle, can also help generate funds for Independent Living.

Public Benefits for Independent Living

While many public benefits primarily cover medical care, some programs can assist with Independent Living costs:

-

Housing Assistance: HUD offers housing vouchers to very low-income seniors under Section 202. Not all Independent Living communities accept these vouchers.

- Supplemental Security Income (SSI): Provides additional stipends for very-low-income seniors. Eligibility criteria include net worth limitations.

Planning for Future Needs

As seniors age, they may require more care than Independent Living can provide. Planning for future needs, including payment options for Assisted Living and Memory Care, is crucial for a smooth transition.

By understanding the costs, and exploring various funding options, seniors and their families can make informed decisions about Independent Living.

Supporting the Senior Living Industry

Recent Helpful Articles

Quick Links

Our Location

ALL RIGHTS RESERVED | FAMILY SHEPHERD | PRIVACY POLICY