Overview of the Jackson County, Missouri Senior Property Tax Credit Program

Jackson County Missouri Property Tax Increases

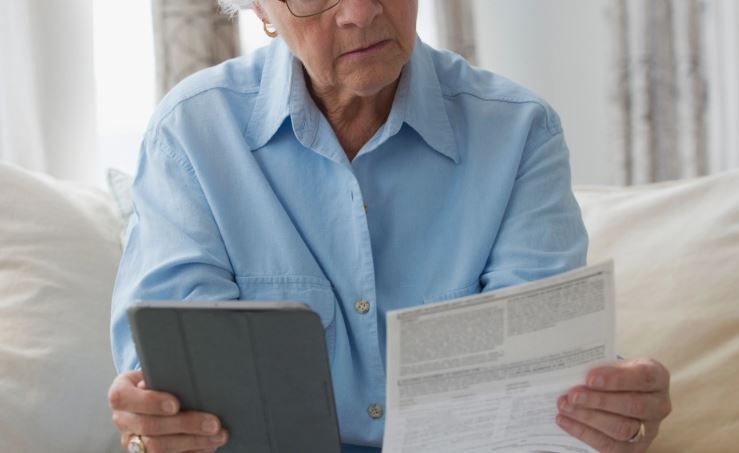

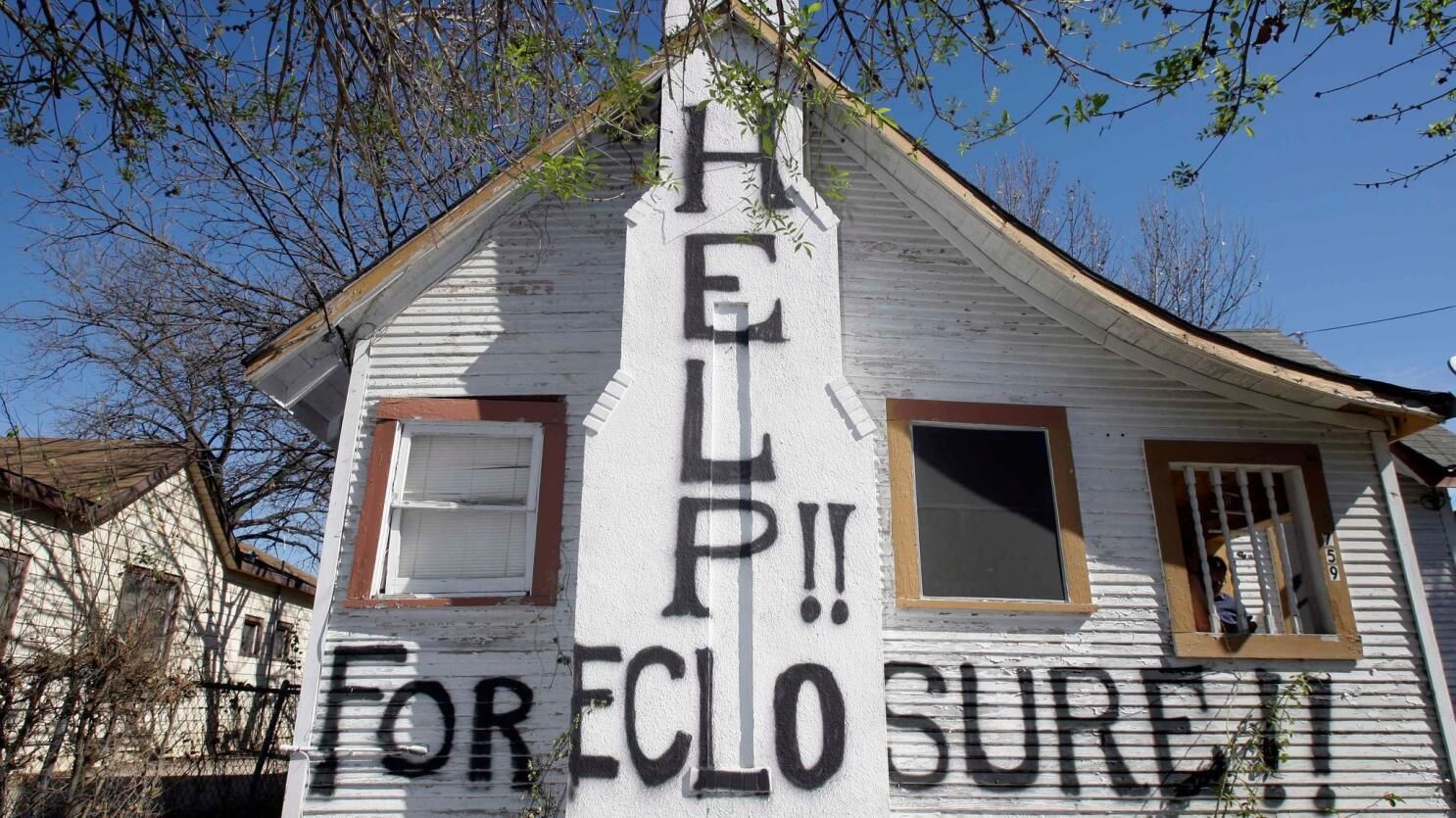

Over the past year, homeowners in Jackson County, Missouri, have experienced a lot of stress and upheaval related to the increase in property taxes. The increase in property taxes has added more stress and strain on seniors on a fixed budget. Seniors are desperately trying to stay in their homes as long as possible to age in place before transitioning out of their homes to live with a family member or to a move to a community for a higher level of care. It's not perfect, but at least legislation is trying to provide some relief to seniors who are also homeowners. It doesn't fix all of the problems. Many seniors live in a rented home and landlords are increasing the monthly rent due to the increased costs of materials and labor needed to maintain the house, property tax increases, as well as higher costs for insurance on the property. If you are a homeowner, I recommend looking into this tax credit program, which may help you stay in your home.

With the passage of Missouri Senate Bill 190 (SB190) in 2023, Jackson County has introduced a

Senior Property Tax Credit Program designed to provide significant tax relief to senior citizens. This program is a vital initiative intended to assist elderly homeowners by stabilizing their property taxes, ensuring they can remain in their homes without the burden of increasing tax rates.

Key Features of the Senior Property Tax Credit Program

Eligibility:

To qualify for the Senior Property Tax Credit Program, applicants must meet the following criteria:

- Social Security Retirement Eligibility: Homeowners must be eligible for Social Security retirement benefits. It's important to note that it is not necessary to be currently drawing these benefits; eligibility alone is sufficient.

- Primary Residence: The property for which the tax credit is being applied must be the homeowner's primary residence.

Program Benefits:

- Tax Freeze: The primary benefit of this program is that it effectively freezes property taxes at their current rate for eligible seniors. This means that once approved, the homeowner's property taxes will not increase, providing predictable and manageable tax expenses year over year.

Application Process:

Jackson County has established a straightforward application process to ensure that seniors can easily apply for this tax relief. Here are the steps to apply:

1. Obtain the Application: Applications can be obtained from the Jackson County Assessment Department's website or in person at their office.

2. Complete the Application: Fill out the required information, ensuring that all eligibility criteria are met.

3. Submit Documentation: Submit the completed application along with any necessary documentation that verifies eligibility, such as proof of age and Social Security retirement eligibility.

4. Await Approval: Once submitted, applications will be reviewed, and eligible homeowners will receive confirmation of their tax freeze status.

Important Considerations:

- Annual Reapplication: Homeowners may need to reapply annually or provide periodic updates to maintain their tax freeze status. This ensures continued eligibility and allows for any necessary adjustments.

- Changes in Residency: If a homeowner sells their primary residence, or no longer uses it as their primary home, they must inform the county to adjust their tax status accordingly.

How Seniors Can Get Help on Property Taxes

For those needing assistance with the application process or seeking more information, Jackson County offers several resources:

- Jackson County Assessment Department: Visit their office or website for detailed information and assistance.

- Local Senior Services: Organizations dedicated to supporting senior citizens can provide guidance and help with the application process.

- If you're looking to age in place, see our article here and learn more about resources available to help you stay in your home longer.

The bottom line

The Senior Property Tax Credit Program in Jackson County, established through SB190, is a crucial measure to help senior citizens manage their property tax obligations. By freezing property taxes for eligible seniors, the program provides financial stability and peace of mind, allowing them to continue enjoying their homes without the stress of rising tax rates.

For more information and to access the application, visit the Jackson County Assessment Department's website

https://www.jacksongov.org/Government/Departments/Collection/Senior-Property-Tax-Credit-Program or contact their office directly. This program is a testament to Jackson County's commitment to supporting its senior residents and ensuring their financial well-being.

Supporting the Senior Living Industry

Recent Helpful Articles

Quick Links

Our Location

ALL RIGHTS RESERVED | FAMILY SHEPHERD | PRIVACY POLICY